The following is a step-by-step guide to getting those numbers and a last AR turnover ratio. Barbara is a monetary author for Tipalti and different profitable B2B companies, including SaaS and financial companies. She is a former CFO for fast-growing tech companies with Deloitte audit experience. Barbara has an MBA from The University of Texas and an active CPA license.

The first a half of the accounts receivable turnover formulation calls for web credit sales, or in different words, the entire gross sales for the yr that were made on credit score (as opposed to cash). This figure should embody the entire credit gross sales, minus any returns or allowances. We should be able to find the online credit gross sales number in the annual revenue assertion or Profit & Loss a/c. On the opposite hand, a low turnover ratio can sign issues, such as delayed collections or poor credit management.

The accounts receivable turnover ratio is important because it provides insight into whether or not your organization is struggling to gather on sales made via extending credit to customers. The ratio is a powerful indicator of your company’s operational and financial efficiency and is a key metric in accounts receivable management. The AR turnover ratio measures your company’s effectivity when amassing outstanding balances while extending credit score. It facilities around what quantity of instances you exchange your receivables into cash within a particular time frame — normally monthly, quarterly, or annually. Accounts receivable turnover ratio, also called receivables turnover ratio or debtor’s turnover ratio, is a measure of effectivity.

Business Benchmarks For Accounts Receivable Turnover Ratio

The AR turnover ratio calculator helps companies efficiently assess how rapidly they collect payments from customers. By calculating this ratio, you’ll have the ability to gain useful insights into cash circulate, determine potential assortment issues, and optimize credit policies. Obtain the calculator now to streamline your monetary analysis and improve https://www.simple-accounting.org/ your receivables administration.

It’s not unusual for companies to provide purchasers 30 days or longer to pay for a services or products. That’s the time during which the enterprise could presumably be reinvesting in itself, paying down money owed, or in any other case addressing its own financial obligations. The actuality is, that mapping out a strategic assortment process is simpler stated than carried out for so much of companies, particularly those who process 100+ invoices month-to-month. In the quick and continuous time period, having a excessive ART Ratio ensures the effectivity of the business’s working capital cycle. In the lengthy run, it performs a key role in securing traders to fund the companies and protect the lifecycle of the company.

Accounts Receivable Turnover Ratio: Definition, Formulation, & How To Calculate It

- As Quickly As you’ve a timeframe in mind, the ratio’s numerator would be the internet credit score sales.

- Every enterprise sells a product and/or service that have to be invoiced and picked up as payment from the shopper, according to the terms set forth within the sale.

- Routinely evaluating your business’s accounts receivable turnover ratio can make it easy to identify potential points with your business’ credit score insurance policies.

- A constantly low ratio signifies a company’s invoice terms are too long.

- This bodes very properly for the cash flow and personal goals in the small doctor’s workplace.

A low ratio can indicate potential money move issues and inefficiencies within the credit score and collection processes, presumably leading to higher dangerous debt bills. A company can improve its ratio by tightening credit insurance policies, implementing efficient collection processes, and regularly reviewing the creditworthiness of its prospects. Internet credit gross sales refers to how a lot revenue an organization earns, particularly revenue paid as credit. The sale must incur an accounts receivable balance in order to be thought of a “net credit sale,” which means money gross sales aren’t included. Accounts Receivable itself refers back to the sum of money prospects owe to the corporate for purchases of goods or providers primarily based on credit. It is a crucial metric for companies that depend on credit score gross sales and need to manage their working capital.

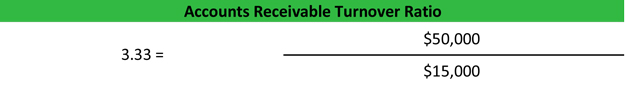

It indicates how tight your AR practices are, what needs work, and the place your corporation can enhance. So, your receivables turnover ratio of five turned over five occasions during the previous year, which suggests you collected your average accounts receivable in 73 days (365 (days) / 5 (ratio)), which is more than days. Now that you’ve these two values, you’ll be able to apply the account receivable turnover ratio. You divide your web credit gross sales by your average receivables to calculate your receivables turnover ratio.

Earlier Than becoming a member of Versapay, Nicole held varied marketing roles in SaaS, financial services, and better ed. Whereas a conservative credit coverage might help limit threat for a enterprise, it could also drive clients to seek the services or products from competitors who’re ready to increase credit score. If you’re fighting gradual collections, think about exploring AR automation tools that can streamline your invoicing and follow-up process. It’s not just a number—it’s a window into your operational efficiency, customer relationships, and overall monetary health.

There’s no commonplace quantity that distinguishes a “good” AR turnover ratio from a “bad” one, as receivables turnover can vary greatly based mostly on the type of business you’ve. The accounts receivable turnover ratio is generally calculated on the finish of the year however also can apply to monthly and quarterly equations and predictions. A small enterprise should calculate the turnover rate regularly because it adjusts to progress and builds new prospects or purchasers. The accounts receivable turnover ratio is a crucial assumption for driving a stability sheet and money move forecast to make more correct financial predictions. As A Result Of as a enterprise proprietor, your receivables ensure a positive cash circulate.

Receivables turnover ratio is more useful when used at the aspect of quick time period solvency ratios like present ratio and fast ratio. These brief term solvency indicators measure the liquidity position of the entity as an entire and receivables turnover ratio measure the liquidity of accounts receivable as an individual current asset. It is much like the inventory turnover ratio which measures how fast the stock is transferring in a business. A high ratio is desirable, because it indicates that the company’s collection of accounts receivable is frequent and environment friendly. A excessive accounts receivable turnover also indicates that the corporate enjoys a high-quality customer base that is prepared to pay its money owed quickly. Also, a high ratio can recommend that the company follows a conservative credit policy, corresponding to net-20-days or maybe a net-10-days coverage.

This indicates the variety of occasions common debtors have been converted into cash throughout a 12 months. This can be referred to as the effectivity ratio that measures the corporate’s capacity to collect income. It also helps interpret the effectivity in utilizing a company’s assets in probably the most optimum way. Now that you’ve seen how the receivables turnover ratio is calculated, let’s understand the method to interpret the outcomes and what they reveal about your collections performance.

Leave a Reply